ETF gold demand from investors has soared over the past year. The unprecedented fiscal and monetary stimulus were rolled out to tackle the effects of Covid -19. However, consumer demand, particularly but not surprisingly, jewellery demand slumped.

What’s in store for gold demand fundamentals for 2021?

Increased consumer demand in China and India will help support the gold price in 2021. There is little doubt that investment demand – especially into Exchange Traded Funds (ETFs), the similar products was the main driver of the gold price higher in 2020. According to World Gold Council data, total ETF demand surged 120% from 398.3 tonnes in 2019 to a new record high in 877.1 tonnes in 2020. However, consumer demand, comprised of jewellery plus bar as coin demand declined a significant 22% in 2020 from 2019. Jewelry demand was hit hardest with a decline of 34%.

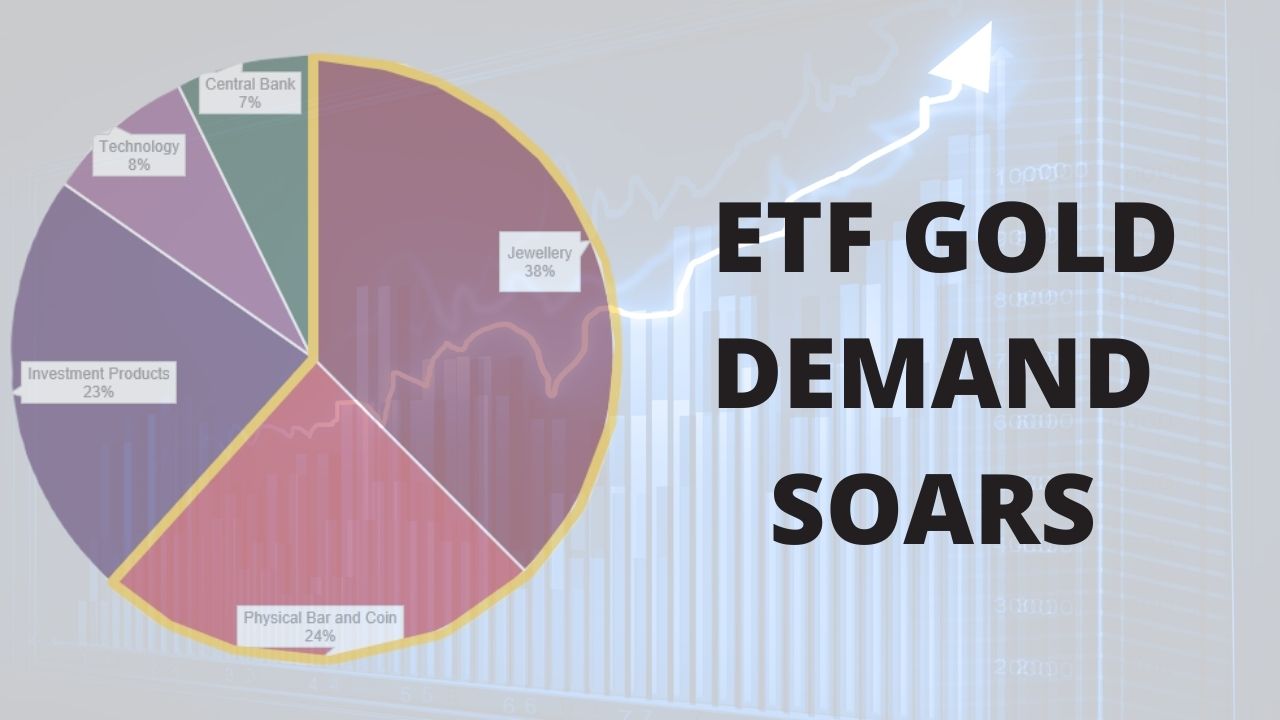

Looking back to 2020, the first chart below breaks down gold demand in 2020 by sector. Jewellery comprised 38% of demand in 2020, Physical Bar alongwith Coin 24%, and so on. The smaller chart shows the percent of consumer demand for the top 10 countries, which comprise 67% of total consumer demand. In 2020 China and India accounted for 46% of consumer demand.

China’s consumer demand in 2020 was 28% lower than in 2019, alongwith 54% below the 2013 peak.

The Optimistic Appoarch

Turning to the outlook for 2021. UBS now forecasts China’s economy to grow more than 9% in 2021, the fastest growth in a decade. This is raised from initial estimates of growth of around 8.2% due to the increased exports as the result of the $1.9 billion US fiscal package passed this week. The updated UBS forecast also expects, Chinese GDP is likely to expand more than 19% this quarter. When compared to the first three months of 2020, when the nation was in lockdown. This rapid economic growth will boost gold demand to 2019 levels.

The WGC Council reports that their “fieldwork indicates an optimistic attitude among major jewellers in China. Who experienced strong sales in recent months. The main reasons behind the more positive outlook over the coming months are:

- The expectation of continued strength in China’s economy, leading to faster growth in consumer disposable income;

- Chinese policy makers have positioned domestic consumption as a priority in coming years;

- Industry consolidation in 2020 weeded out jewellers with weak brand value and problematic cash flows, putting the industry in a healthier position, and

- COVID-19 is widely expected by those in the trade to remain well contained in China”

Measures to increase the demand of Gold in India

The second largest consumer of gold is India, where consumer demand declined by 35% in 2020 from 2019 levels. However, on top of the economic recovery from the Covid-19 pandemic the budget announced on February 1 had several measures since it will help boost gold demand. The most prominent one being the reduction of the gold import duty. The budget also announced the authorisation of the Securities with Exchange Board of India (SEBI) as the regulator for domestic gold spot exchanges and the establishment of welfare schemes for rural areas to boost incomes.

According to the World Gold Council: “The lower import duty will likely enhance consumer demand and discourage unofficial imports. Oversight by SEBI may spur infrastructure development and likely lead to higher trading and more effective gold price discovery. And the rural welfare schemes may indirectly support gold demand through income growth. We believe that this, combined with better gold policies, could bode well for India’s gold industry in 2021 and beyond.”

The WGC went on to note: “The government’s focus on the rural economy is especially important for gold demand. Rural India accounts for around two-thirds of the nation’s gold demand, and this is heavily linked to income levels. Indeed, our econometric analysis reveals that, as a rule of thumb, a 1% increase in income leads to a 1% increase in gold demand, all else being equal.”

Bottom Line: The gold and silver markets are global and the increased consumer demand in China and India, accounting for close to 50% of consumer demand, will help support the gold price in 2021. This additional consumer demand driven support is additional to investment demand driven by governments supressing yields in coming years. The global nature of gold and silver is part of what makes the metals truly real money as they are accepted the world over. Gold and silver are wealth that sustains in the absence of banks, debt or governments.

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

17-03-2021 1736.95 1729.65 1248.35 1246.56 1458.00 1452.56

16-03-2021 1732.30 1735.00 1251.93 1249.20 1450.63 1457.23

15-03-2021 1727.90 1723.65 1240.98 1241.03 1449.02 1445.45

12-03-2021 1703.85 1704.80 1223.88 1227.46 1429.87 1428.96

11-03-2021 1736.35 1724.25 1244.27 1235.08 1451.41 1443.89

10-03-2021 1711.50 1716.20 1231.94 1233.60 1438.86 1440.92

09-03-2021 1702.85 1716.90 1228.10 1233.25 1430.73 1442.20

08-03-2021 1694.45 1687.05 1224.58 1220.07 1427.07 1420.33

05-03-2021 1696.05 1696.25 1228.96 1227.75 1421.12 1423.83

04-03-2021 1710.05 1712.10 1227.47 1224.49 1420.20 1422.07

Buy gold coins and bars and store them in the safest vaults in Zurich, Switzerland with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here